Transforming Finance Innovation

Customized Solutions Revolutionizing Financial

Decisions and Management

Request Demo

Dashboard Access

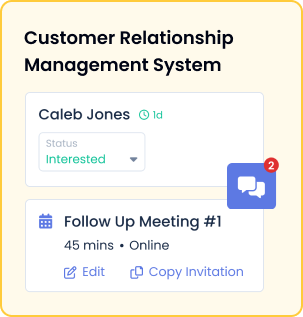

Dashboard Access Customer List

Customer List  Loan Application

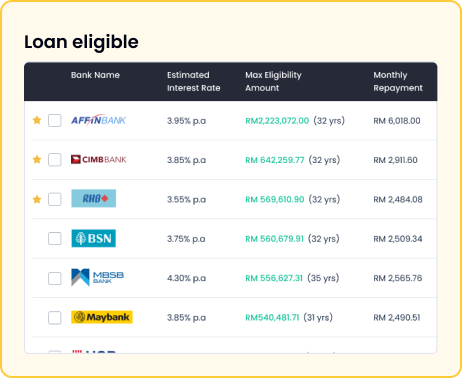

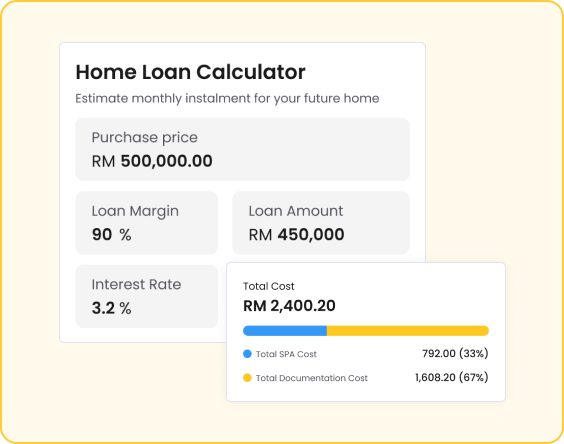

Loan Application Comprehensive Calculator

Comprehensive Calculator FINTSCORE Credit Report

FINTSCORE Credit Report Hub Management

Hub Management Payout Feature

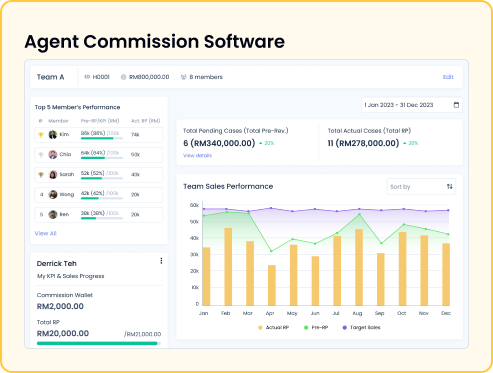

Payout Feature Sales Tracking

Sales Tracking Pool Approval

Pool Approval  Recruitment Tracking

Recruitment Tracking Create Lead

Create Lead Bulk Upload Leads

Bulk Upload Leads Chat Messaging Function

Chat Messaging Function Auto Lead Assignment

Auto Lead Assignment New Project Notifications

New Project Notifications Booking Management

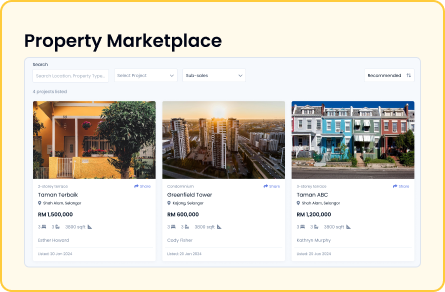

Booking Management Selling Status Updates

Selling Status Updates Project Marketing Tools

Project Marketing Tools

Streamline lending operations by covering customer management

Make smart financial decisions with our comprehensive calculator app

Techapp International Sdn Bhd, operating under FINTOS Tech, is a leading FinTech development division dedicated to creating advanced financial analysis systems for business partners and individuals. Our main goal is to offer innovative fintech solutions that streamline processes and boost application success.

Our flagship product, the Fintos app, simplifies financial processes, offering diverse services for efficient management and decision-making.

Manage, optimize, and track loans with one integrated system tailored to your business needs.

Request Demo Contact us at: 03-8080 9777 (#3001)

Contact us at: 03-8080 9777 (#3001)